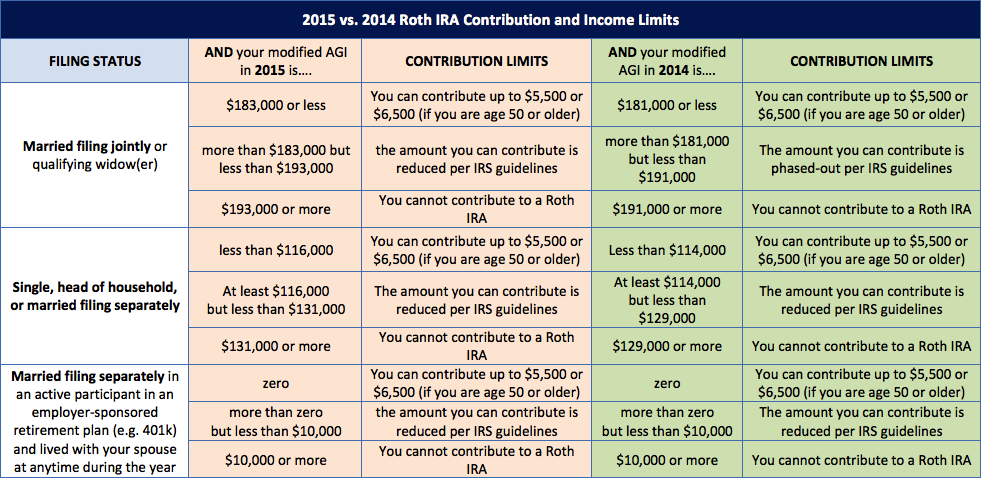

If your income is too high to deduct contributions to a traditional IRA, you might qualify for a Roth IRA. However, contributions to a Roth IRA aren’t tax deductible. Roth IRA contributions are still a long-term investment in a retirement savings plan. Roth IRA rules. Roth You can’t make a Roth IRA contribution if your modified AGI is $, or more. Your filing status is single, head of household, or married filing separately and you didn’t live with your spouse at any time in and your modified AGI is at least $, You can’t make a Roth IRA contribution if your modified AGI is $, or more H—Direct rollover of a designated Roth account distribution to a Roth IRA. J—Early distribution from a Roth IRA, no known exception (in most cases, under age 59½). N—Recharacterized IRA contribution made for and recharacterized in P—Excess contributions plus earnings/ excess deferrals (and/or earnings) taxable in

Traditional IRA Benefits | The Motley Fool

Large Roth IRAs owned by the superrich are in the tax spotlight now, roth ira limits single 2015, and all savers should consider the implications for their own retirement accounts, roth ira limits single 2015. The story claimed some wealthy Americans have multimillion- or even billion-dollar, tax-advantaged retirement-savings accounts.

How could a Roth IRA be that large? If someone can put very low-cost, very high-growth assets into a Roth IRA—as Mr. Thiel is said to have done with investments including PayPal shares costing less than a penny each—then federal taxes on transactions and growth in the account can be nil.

Withdrawals are often tax-free as well. Getty Images. Senate Finance Committee Chairman Ron Wyden D. has vowed to pursue curbs. The new focus on IRA limits raises questions about saving strategies for everyone, not just the superrich. Many financial planners are urging clients to convert traditional IRA assets into Roth ira limits single 2015 IRAs.

The idea is to position for possible higher tax rates down the road either from a law change or asset growth, although the switch means accelerating tax bills. Savers should take seriously the chance that Congress will enact new retirement-plan restrictions, as they have been an area of bipartisan agreement recently.

The change deprived many future heirs of decades of tax-free growth. It also enraged account owners who planned based on prior law, because the provision took effect for deaths starting Jan, roth ira limits single 2015.

So when a worker contributes to a Roth account or someone converts assets from a traditional IRA into a Roth IRA, Uncle Sam receives revenue. What will happen is unclear, but a number of existing roth ira limits single 2015 would impose limits on IRAs, mostly large Roth IRAs. In and again recently, Sen. His aim: to stem the government subsidy of "mega Roths.

Mark Iwry, who oversaw national retirement policy at the Treasury Department during the Clinton and Obama administrations, expects a cap to be higher if one is enacted, based on his experience.

One rule would require half the excess amount in the Roth IRA to be paid out each year. These payouts would likely be tax-free. Inthe Obama administration proposed that Roth IRA holders be required to take minimum annual payouts from their accounts. This is not part of Mr. Iwry thinks it unlikely, at least without grandfathering existing accounts.

FORGET THESE 4 FINANCIAL MYTHS TO RETIRE STRESS-FREE. Currently, there is no income threshold. Ending or restricting Roth conversions could cost the government revenue, depending on details. Current law allows both traditional IRAs and Roth IRAs to be invested in a wide variety of assets, including real estate, nonpublic stock, cryptocurrency or a sports franchise.

CLICK HERE TO READ MORE ON FOX BUSINESS. Abuses could involve undervaluations of assets like nonpublic stock, or self-dealing—such as having an IRA hold a rental house on the beach and then using it oneself. Fox Business Flash top headlines for July 2 Check out what's clicking on FoxBusiness.

Rules For The Traditional And Roth IRA Contributions | H&R Block

· So that’s one way a billionaire could have a huge Roth IRA, although the law doesn’t allow Roth IRA contributions for if income is $, or more for single filers, or $, or more You can’t make a Roth IRA contribution if your modified AGI is $, or more. Your filing status is single, head of household, or married filing separately and you didn’t live with your spouse at any time in and your modified AGI is at least $, You can’t make a Roth IRA contribution if your modified AGI is $, or more If your income is too high to deduct contributions to a traditional IRA, you might qualify for a Roth IRA. However, contributions to a Roth IRA aren’t tax deductible. Roth IRA contributions are still a long-term investment in a retirement savings plan. Roth IRA rules. Roth

Keine Kommentare:

Kommentar veröffentlichen